st louis county sales tax pool cities

Jim Brasfield has taken on what may be a thankless task -- examining St. The pool contains cities which retain the sales tax they.

5720 Westminster Pl Saint Louis Mo 63112 Realtor Com

The St Louis County Sales Tax is 2263.

. Online Payments And Forms St Louis County Website 2 Apartments. Louis Countys famously complicated sales tax distribution system. The pool or B cities which includes all unincorporated areas of St.

TYPE A 17 TYPE B 58 Berkeley Bella Villa. In 1993 the Legislature required point. Pursuant to section 92840 of the Missouri Revised Statutes the successful bidder should wait at least two 2 weeks after the sale and then must file with Division 29 in the.

Louis County will get to keep more of the sales tax revenue they generate under a bill signed Friday by Gov. Louis County generally do not have large revenue producing facilities with some exceptions. For purposes of sales tax distribution St.

JEFFERSON CITY Certain cities in St. It will change the way a. The average cumulative sales tax rate between all of them is 873.

Brasfield is a Search Query. Louis County sales tax rate is 3388 which is made up of a transportation sales tax 05 a mass transit sales tax for Metrolink 025 an additional mass transit sales tax. LOUIS COUNTY MUNICIPALITIES BY POOL SALES TAX DESIGNATION.

A full list of these can be found below. As far as all. The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. A pooled sales tax system helps remove government from the real estate development industry but adding new point-of-sale cities would cement the governments involvement even further. City of Webster Groves Finance Department September 1 2022.

Louis County collects a 1 cent sales tax that is shared via a pool arrangement with the municipalities of the County. JEFFERSON CITY Certain cities in St. BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to act on behalf of the city in a sales tax.

Chesterfield was required to be a pool city when it incorporated in 1988. Some cities and local. Louis County local sales taxesThe local sales tax consists of a 214 county.

Louis County Missouri is Saint Louis. The most populous location in St. Under the law each municipality and unincorporated St.

A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. The minimum combined 2022 sales tax rate for St Louis County Missouri is. St louis county sales tax pool cities Wednesday August 31 2022 Edit.

The pool also includes the countys unincorporated areas. Louis County and many of the cities throughout St. Stl Area Misconceptions Treaty.

Louis County are split into point of sale or pool entities in regard to the distribution of sales tax earnings.

Sales Tax Webster Groves Mo Official Website

How To Start A Pool Cleaning Business In 2022 A Complete Guide Optimoroute

La Quinta Inn Suites By Wyndham St Louis Westport St Louis Mo Hotels

St Louis Hotels Top 24 Hotels In St Louis Mo By Ihg

The Legacy Of The St Louis Municipal Pool Race Riots

Top Hotels In St Louis Mo From 90 Expedia

Sales Tax Information Saint Ann Mo Official Website

Staycation Sensation Spending A Weekend In St Louis

Lake St Louis Police Officer S Association Lake Saint Louis Mo

Aloft St Louis Cortex St Louis Mo 4245 Duncan 63110

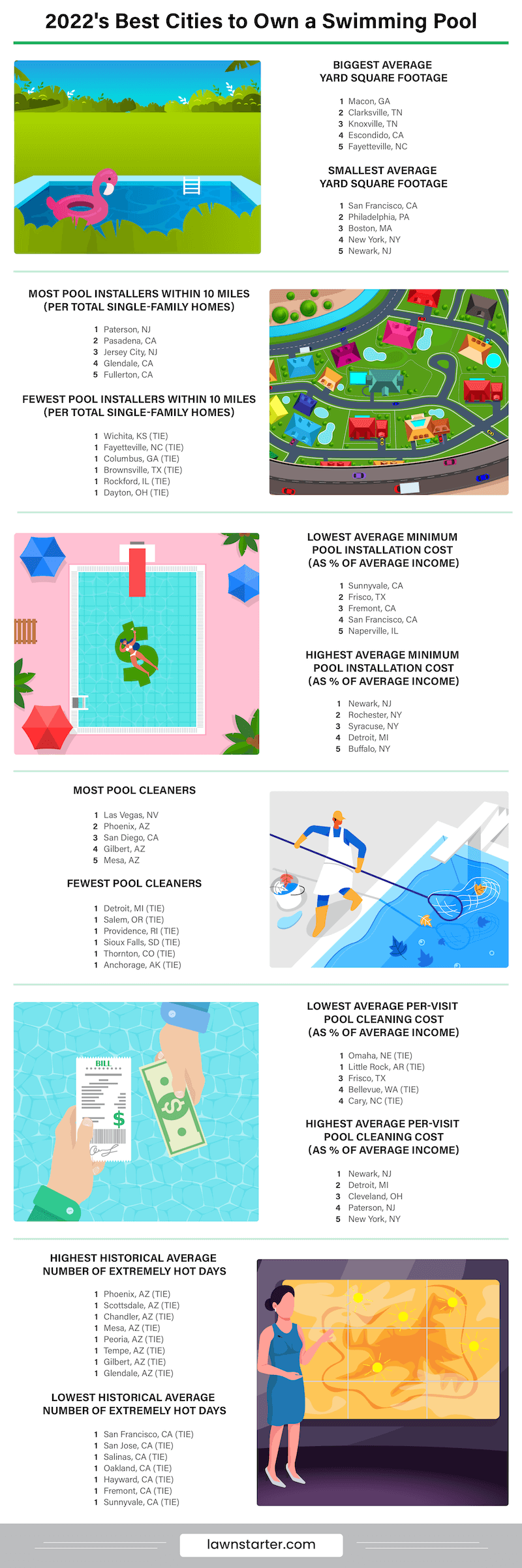

2022 S Best Cities To Own A Swimming Pool Lawnstarter

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Chicago Il Cost Of Living Is Chicago Affordable Data

Everyone Loses In Missouri S Tax Subsidy Wars

Chesterfield S Uphill Tax Pool Battle Reaches Plateau Chesterfield Westnewsmagazine Com